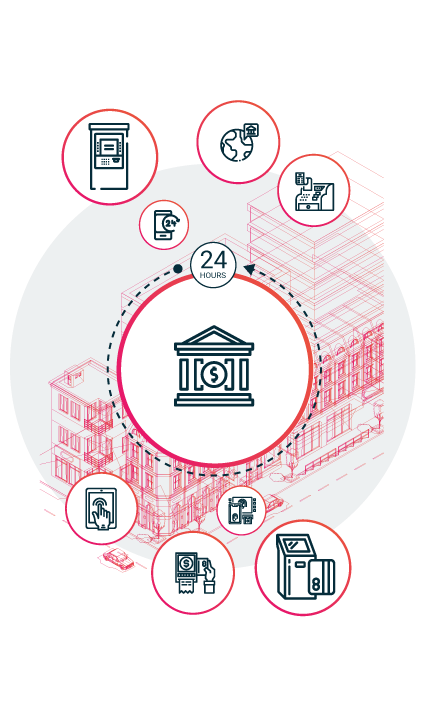

Digital transformation has altered how banks interact with their customers significantly. Whether acting as consumers or business customers, the expectations are that you should be able to interact with your bank 24 hours a day and 365 days a year for seamless engagement. The branch of a bank is no longer just a physical entity, it is also virtual.

Customer engagement is still key to building relationships with customers. Getting personal engagement simply through digital transformation and mobile applications alone is hard to achieve. This is why we at Emerico strives to provide seamless customer experience solutions for banks. From branch transformation through to digital transformation. Working closely with customer experience and branch transformation teams, Emerico customizes those solutions to ensure we maximize opportunities to connect, engage, and effectively interact with your customers – driving more business opportunities.

Within the branch, our focus is to free up your staff. Technology can perform many of the introductions and transactions to ensure your team can focus on specific customer support and solutions business development. The aim is to provide a retail-style of experience that the customer expects and desires. Blending physical, technical, and digital banking platforms will help drive loyalty and enhance the customer experience.

Beyond the main branch, our focus is on extending your engagement opportunities as much as possible. This can be achieved by enabling external agents, such as convenience stores or cafes; or enabling the end customer with smart digital platforms that can be utilized 24 hours a day to manage finances simply and efficiently. This cost-effective solution provides seamless customer engagement and experience.

Delivering

On-Boarding

Customer onboarding has been a focal element of Emerico for over a decade. The aim is to reduce costs within branches and broaden your geographical market opportunity through remote onboarding solutions. The high levels of functionality within our teller machines and mobility devices ensure that you can effectively interact, engage, and provide the right tools for your customers to embed themselves into your business. From customer identification, engaging through video, to document sharing, and providing, you can ensure your customer onboarding is effective.

Security &

Authentication

We know that security is important to you and your customers. This is why we have delivered several options for you to utilize our solutions. Our security solutions include multi-factor/two-factor authentication, pin/pad code recognition, passport scanner, barcode scanner, facial recognition, and fingerprint recognition. We have a solution that meets the needs of you and your customer.

Smart

Communications

We utilize smart communications including audio and video conferencing, support customers with intelligent AI-powered chat and enable faster access and security through voice and facial recognition across a portfolio of technology and software platforms to bring your remote customers close to home. From remote teller machines to mobile device applications, you can effectively interact via video to build relationships with your customers. In a time of carbon footprint reduction and world health scares, this technology ensures your customer interaction can be ongoing.

Case Studies

Read about some of Emerico's case study projects across the globe.

Solutions Brochure

Download our latest solutions, technology and software platforms and services brochure.

© 2025 Emerico Limited.

Emerico Limited, 6203 San Ignacio Avenue, Suite 110, San Jose, California, 95119, USA